Several people have asked my opinion of the Federal Reserve's new round of quantitative easing. In particular, some have noted that I did not sign the

open letter by conservative economists critical of recent Fed actions.

My view is that QE2 is a modestly good idea. I say it is a "good idea" because, like Ben Bernanke, I am more worried at the moment about Japanese-style deflation and stagnation than I am about excessive inflation. By lowering long-term real interest rates below where they otherwise would be, QE2 should help expand aggregate demand. I include the modifier "modestly" because I don't expect these actions to have a very large effect.

Moreover, I do see some potential downsides. In particular, the Fed is making its portfolio riskier. By borrowing short and investing long, the Fed is in some ways becoming the hedge fund of last resort. If future events require higher interest rates, the Fed will end up making losses on its portfolio. And even if doesn't recognize these losses (by not marking to market), it could end up paying more interest on newly expanded reserves than it is earning on its newly acquired portfolio of long bonds. Such a cash-flow deficit could potentially undermine the Fed's political independence (which is already not very popular in some circles). Yet if the Fed tries to avoid these losses by failing to raise rates when needed, inflation could indeed become a problem down the road. I trust the team at the Fed enough to think they will avoid that mistake.

So, in the end, I judge QE2 to be a small but risky step in the right direction.

-----

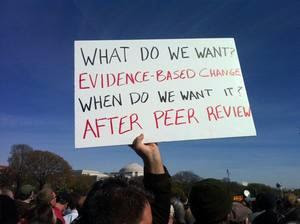

Addendum: While I do not agree with its conclusion, I did find

this video on QE2 amusing.